M.SC. in Computer Engineering (Without Thesis)

FM 551 | Course Introduction and Application Information

| Course Name |

Scientific Computation and Simulation in Finance

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

FM 551

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | - | |||||

| Course Lecturer(s) | - | |||||

| Assistant(s) | - | |||||

| Course Objectives | Scientific computation and simulation in finance is a crossdisciplinary field which relies on mathematical finance, numerical methods and computer simulations to make trading, hedging and investment decisions, as well as facilitating the risk management of those decisions. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | Scientific computation and simulation in finance is a crossdisciplinary field which relies on mathematical finance, numerical methods and computer simulations to make trading, hedging and investment decisions, as well as facilitating the risk management of those decisions. |

| Related Sustainable Development Goals |

|

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Errors, Condition Numbers, Norms | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 2 | Solving Linear Systems (Application: Markov Chains) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 3 | Best fit and least squares (Application: CAPM) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 4 | Nonlinear Equations (Application: Implied Volatility) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 5 | Optimization (Application: Optimal Portfolios) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 6 | Interpolation (Application) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 7 | Quadrature (Application: Pricing European Claims) | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 8 | Numerical MEthods for ODEs | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 9 | BlackScholes PDE and Heat Equation | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 10 | Explicit Finite Differences for PDEs | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 11 | Backward Finite Differences & CrankNicolson Scheme | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 12 | Pricing European Claims | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 13 | CRR Model and Binomial trees | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 14 | Numerical Methods for American Options | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 15 | Special methods for interestrate models | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| 16 | Review of the Semester |

| Course Notes/Textbooks | Seydel, R. Tools for Computational Finance (latest edition).Siegman and Davis. Matlab Primer, Chapman/Hall. |

| Suggested Readings/Materials | Implementing derivative models. Authors: L. Clewlow, Ch. Strickland. John Wiley and Sons, Ltd., 1998.Statistical Analysis of Financial Data in SPlus. Authors: Ren A. Carmona. Springer Texts in Statistics, January 2004. Introduction to Stochastic Calculus Applied to Finance. Authors: D. Lamberton and B. Lapeyre. Chapman and Hall/CRC, 1996. |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project |

1

|

20

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

50

|

| Total |

| Weighting of Semester Activities on the Final Grade |

50

|

|

| Weighting of End-of-Semester Activities on the Final Grade |

50

|

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

15

|

5

|

75

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

1

|

30

|

30

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

32

|

32

|

| Final Exam |

1

|

40

|

40

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 | Accesses information in breadth and depth by conducting scientific research in Computer Engineering, evaluates, interprets and applies information. |

-

|

-

|

-

|

X

|

-

|

|

| 2 | Is well-informed about contemporary techniques and methods used in Computer Engineering and their limitations. |

-

|

-

|

-

|

-

|

X

|

|

| 3 | Uses scientific methods to complete and apply information from uncertain, limited or incomplete data, can combine and use information from different disciplines. |

-

|

-

|

-

|

X

|

-

|

|

| 4 | Is informed about new and upcoming applications in the field and learns them whenever necessary. |

-

|

-

|

-

|

-

|

X

|

|

| 5 | Defines and formulates problems related to Computer Engineering, develops methods to solve them and uses progressive methods in solutions. |

-

|

-

|

-

|

-

|

X

|

|

| 6 | Develops novel and/or original methods, designs complex systems or processes and develops progressive/alternative solutions in designs. |

-

|

-

|

-

|

-

|

X

|

|

| 7 | Designs and implements studies based on theory, experiments and modelling, analyses and resolves the complex problems that arise in this process. |

-

|

-

|

-

|

X

|

-

|

|

| 8 | Can work effectively in interdisciplinary teams as well as teams of the same discipline, can lead such teams and can develop approaches for resolving complex situations, can work independently and takes responsibility. |

-

|

-

|

-

|

-

|

X

|

|

| 9 | Engages in written and oral communication at least in Level B2 of the European Language Portfolio Global Scale. |

-

|

-

|

X

|

-

|

-

|

|

| 10 | Communicates the process and the results of his/her studies in national and international venues systematically, clearly and in written or oral form. |

-

|

-

|

X

|

-

|

-

|

|

| 11 | Is knowledgeable about the social, environmental, health, security and law implications of Computer Engineering applications, knows their project management and business applications, and is aware of their limitations in Computer Engineering applications. |

-

|

-

|

X

|

-

|

-

|

|

| 12 | Highly regards scientific and ethical values in data collection, interpretation, communication and in every professional activity. |

-

|

X

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

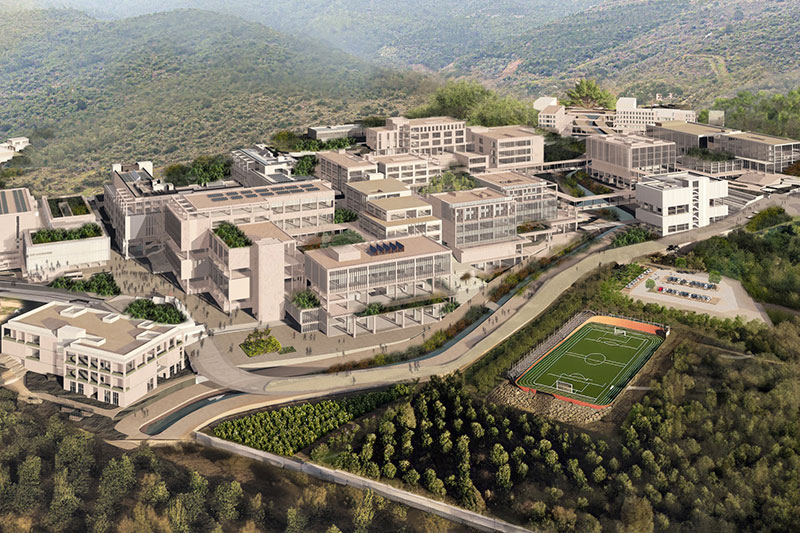

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..

You are one step ahead with your graduate education at Izmir University of Economics.