ECON 511 | Course Introduction and Application Information

| Course Name |

Funds Management in Commercial Banks

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ECON 511

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | - | |||||

| Course Lecturer(s) | - | |||||

| Assistant(s) | - | |||||

| Course Objectives | To acquaint the graduate students with the very basics of fund management (treasury management) at commercial banks, help them understand market risks, and capital and liquidity adequacy for commercial banks, develop their own interpretations on BASEL I, II, and III. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | The course focuses on treasury management issues of commercial banks. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Funds and commercial banks, a quick look at the financial markets | |

| 2 | A quick reminder about securities, A quick reminder about foreign exchanges, and trading techniques | |

| 3 | Derivatives under the roof of futures exchanges, and over the counter contracts | |

| 4 | The relationship between interest rates and bond prices, yield concepts per se, Pricing and handling securities at the Istanbul Stock Exchange, Money market yields | |

| 5 | Duration models, GAP analyses, Asset and liabilities management | |

| 6 | Managing interest rate risk | |

| 7 | Financial futures and interest rate swaps | |

| 8 | Use of options on financial futures | |

| 9 | Reserve requirement for banks, Capital and liquidity ratios for banks in Turkey, BASELL I, II, III | |

| 10 | Fund raising techniques worth mentioning separately, Syndicated loans, REPOs and REVERSE REPOs | |

| 11 | Turkish Interbank | |

| 12 | Fund utilizations in Turkish banking | |

| 13 | Risk and return concepts and calculations, Portfolio management, The Markowitz Model, Expost versus exante calculations | |

| 14 | Risk of security, Portfolio risk, Covariance | |

| 15 | Offbalancesheet items, Securitization, Mortgage financing | |

| 16 | Review of the Semester |

| Course Notes/Textbooks | Mr. Halit Soydan’s own Course Notes for ECON511 and Mr. Halit Soydan’s published book: Capital Markets (Used at present at the State University of Dokuz Eylül in Izmir) |

| Suggested Readings/Materials | Supplementary reading materials: (In addition to current hot topics of the week as appear at Turkish and international press, dailies, periodicals at electronic media or otherwise): Bank Management by Timothy W Koch, The Dreyden Press; Investment Analysis and Management by Charles P Jones, John Wiley and Sons; The Mathematics of Banking and Finance by Dennis Cox, Michael Cox; Mastering Financial Mathematics by Alastair L Day |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation |

16

|

15

|

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project |

1

|

15

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

60

|

|

| Weighting of End-of-Semester Activities on the Final Grade |

40

|

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

5

|

80

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

1

|

25

|

25

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

32

|

32

|

| Final Exam |

1

|

40

|

40

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To improve and deepen expertise in economics and finance. |

-

|

-

|

-

|

-

|

X

|

|

| 2 |

To be able to comprehend the interaction between economics, finance and related fields. |

-

|

-

|

-

|

-

|

-

|

|

| 3 |

To be able to apply the advanced level knowledge acquired in economics and finance. |

-

|

-

|

-

|

-

|

-

|

|

| 4 |

To be able to create new knowledge by combining the knowledge of finance and economics with the knowledge coming from other disciplines and be able to solve problems which requires expert knowledge by applying scientific methods. |

-

|

-

|

-

|

-

|

-

|

|

| 5 |

To be able to use computer programs needed in the fields of economics and finance as well as information and communication technologies in advanced levels. |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to think analytically to identify problems in finance and economics and to be able to make policy recommendations in economics and finance based on scientific analysis of issues and problems. |

-

|

-

|

-

|

-

|

X

|

|

| 7 |

To be able to develop new strategic approaches for unexpected, complicated situations in finance and economics and take responsibility in solving it. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To protect the social, scientific and ethical values at the data collection, interpretation and dissemination stages and to be able to institute and observe these values. |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to critically evaluate the knowledge in finance and economics, to lead learning and carry out advanced level research independently. |

-

|

-

|

-

|

-

|

X

|

|

| 10 |

To be able to use a foreign language for both following scientific progress and for written and oral communication. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

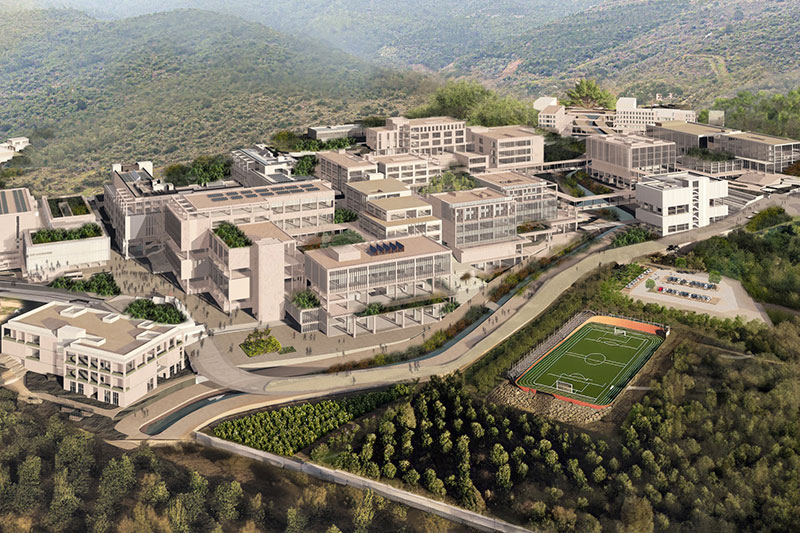

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..