ECON 516 | Course Introduction and Application Information

| Course Name |

Economics of Risk and Institutional Risk

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ECON 516

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | - | |||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | To teach students the fundamentals of risk management and its evolution over time. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | The course focuses on the fundamentals of risk management and its evolution over time. It focuses on how to define, measure and manage risk by taking the students through a historical journey and introducing the heroes that contributed to the profession, from Bernoulli to Laplace, to Keynes, Kenneth Arrow, the father of risk management and derivatives. Later in the semester the course focuses on modern allocations of risk management with specific emphasis on company balance and bank balance sheets, operations of insurance companies etc. It concludes with tools to manage risk. |

| Related Sustainable Development Goals |

|

|

|

Core Courses | |

| Major Area Courses |

X

|

|

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Risk Definitions, Risk Types and Risk Resources | • Defining Risk (Glyn A. Holton) http://thegordian.net/wp-content/uploads/2006/10/risk.pdf • Types of Risks—Risk Exposures http://catalog.flatworldknowledge.com/bookhub/1?e=baranoff-ch01_s04 |

| 2 | Risk theories | • History of Finance (Merton H. Miller) • Risk, theory, reflection: Limitations of the stochastic model of uncertainty in financial risk analysis (Barry du Toit ) |

| 3 | Institutional Risk Management | Rethinking risk management (René M. Stulz) |

| 4 | Risk Analysis in Economics | Systemic Risk And The Macroeconomy: An Empirical Evaluation http://www.nber.org/papers/w20963 |

| 5 | Risk Analysis in Finance | • The Challenges of Risk Management in Diversified Financial Companies (Christine M. Cumming and Beverly J. Hirtle) • How do global investors differentiate between sovereign risks? The new normal versus the old, Marlene Amstad, Eli Remolona and Jimmy Shek |

| 6 | Risk Measurement Models and Techniques | Quantitative Risk Management: Concepts, Techniques and ToolsAlexander J. McNeil Rudiger ¨ Frey Paul Embrechts |

| 7 | Application of Risk Measurement | • Volatility, Correlation And Tails For Systemic Risk Measurement (Christian T. Brownlees and Robert Engle) • Credit risk measurement: Developments over the last 20 years (Edward I. Altman, Anthony Saunders) |

| 8 | Mid-Term | |

| 9 | Risk Analysis of Non Finance Sectors | Management of non-financial risks http://www.bis.org/publ/othp04_8.pdf |

| 10 | Risk Management Applications of Non Finance Sectors | • Non-financial risk assessment in mergers, acquisitions and investments (Erik Allenstr¨om and Fredrik Njurell) • Financial and Non-Financial Business Risk Perspectives –Empirical Evidence from Commercial Banks (Khizer Ali, Akhtar and Sadaqat) |

| 11 | Risk Analysis of Finance Sectors | • Systemic Risk Analysis of Turkish Financial Institutions with Systemic Expected Shortfall, İrem Talaslı • Systemic risk in the financial sector: An analysis of the subprime-mortgage financial crisis, Martin F. Hellwig |

| 12 | Risk Management Applications of Finance Sectors | • Excess Credit Risk and Bank’s Default Risk An Application of Default Prediction Models to Banks from EME , C.J. Godlewkski • Econometric Measures Of Systemic Risk In The Finance And Insurance Sectors, Monica Billio, Mila Getmansky, Andrew W. Lo, Loriana Pelizzon |

| 13 | Risk Management by using derivatives | • Derivatives usage in risk management by U.S. and German non-financial firms: A comparative survey, Bodnar, Gordon M.; Gebhardt, Günther • Electricity derivatives and risk management, S.J. Denga, and S.S. Oren |

| 14 | Derivatives Applications for Risk Management | • Dynamic Risk Management of Commodity Operations: Model and Analysis Sripad K Devalkar Ravi Anupindi, Amitabh Sinha • Introduction To Derivatives And Risk Management, D Chance, R Brooks |

| 15 | Presentations and Delivery of Projects | |

| 16 | Review of the Semester |

| Course Notes/Textbooks | |

| Suggested Readings/Materials |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation |

16

|

10

|

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project |

1

|

50

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

40

|

| Final Exam | ||

| Total |

| Weighting of Semester Activities on the Final Grade |

17

|

50

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

50

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

6

|

96

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

1

|

40

|

40

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

20

|

20

|

| Final Exam |

0

|

||

| Total |

204

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To improve and deepen expertise in economics and finance. |

-

|

-

|

-

|

-

|

X

|

|

| 2 |

To be able to comprehend the interaction between economics, finance and related fields. |

-

|

-

|

-

|

-

|

-

|

|

| 3 |

To be able to apply the advanced level knowledge acquired in economics and finance. |

-

|

-

|

-

|

-

|

X

|

|

| 4 |

To be able to create new knowledge by combining the knowledge of finance and economics with the knowledge coming from other disciplines and be able to solve problems which requires expert knowledge by applying scientific methods. |

-

|

-

|

-

|

-

|

X

|

|

| 5 |

To be able to use computer programs needed in the fields of economics and finance as well as information and communication technologies in advanced levels. |

-

|

-

|

-

|

-

|

X

|

|

| 6 |

To be able to think analytically to identify problems in finance and economics and to be able to make policy recommendations in economics and finance based on scientific analysis of issues and problems. |

-

|

-

|

-

|

-

|

X

|

|

| 7 |

To be able to develop new strategic approaches for unexpected, complicated situations in finance and economics and take responsibility in solving it. |

-

|

-

|

-

|

X

|

-

|

|

| 8 |

To protect the social, scientific and ethical values at the data collection, interpretation and dissemination stages and to be able to institute and observe these values. |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to critically evaluate the knowledge in finance and economics, to lead learning and carry out advanced level research independently. |

-

|

-

|

-

|

-

|

X

|

|

| 10 |

To be able to use a foreign language for both following scientific progress and for written and oral communication. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

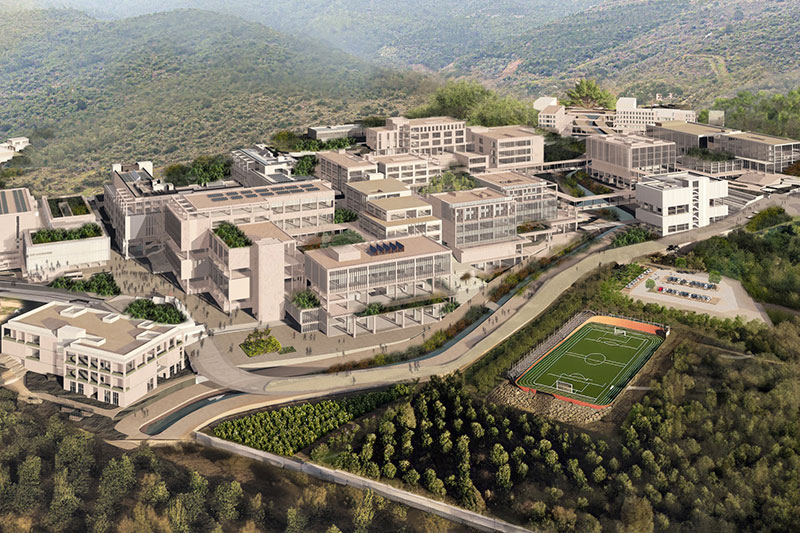

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..