ECON 520 | Course Introduction and Application Information

| Course Name |

International Macroeconomics

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ECON 520

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | ||||||

| Course Objectives | This course provides an overview of issues in international macroeconomics, and develops the concepts and analytic tools necessary for understanding macroeconomic issues under open economy regime(s). |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | This course aims to introduce concepts and analytical tools for studying issues in open economy macroeconomics. To this end, the lectures present concepts and methods of national income and balance of payments accounting, macroeconomic models to explain determination of national output, general price level, interest and exchange rate regimes in open economies that have adopted different exchange rate and capital mobility regimes. Students taking the course will have a better understanding of the key macroeconomic issues facing open economies, including economic crises driven by current account problems. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses |

X

|

|

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Overview of the issues in macroeconomics and challenges facing open economies | Course Notes |

| 2 | National income and balance of payments accounting | Course Notes |

| 3 | Exchange rates and foreign exchange markets | Course Notes |

| 4 | Interest parity, short-term capital flows and carry trade | Course Notes |

| 5 | Money, interest rates and exchange rates | Course Notes |

| 6 | Output and exchange rate determination in the short-run | Course Notes |

| 7 | Recitation and Midterm exam (Nov. 22) | - |

| 8 | Inflation and exchange rate dynamics, Purchasing power parity, Law of one price | Course Notes |

| 9 | Exchange rate regimes and interventions | Course Notes |

| 10 | International monetary system and crises | Course Notes |

| 11 | Recitation and Midterm exam (Dec. 27) | - |

| 12 | International banking and international capital markets | Course Notes |

| 13 | Financial globalization and developing economies | Course Notes |

| 14 | Optimum currency areas and the Euro | Course Notes |

| 15 | Recitation and Final exam | - |

| 16 | Review of the semester |

| Course Notes/Textbooks | Paul R. Krugman, Maurice Obstfeld and Marc J. Melitz, International Economics: Theory and Policy, Pearson Global Edition (10th or later edition) |

| Suggested Readings/Materials | Olivier Blanchard and David R. Johnson, Macroeconomics, Pearson Global Edition (6th or later edition) Serdar Sayan, “Elin İşsizlik Oranı Bizim Faize Kur Mu Yapıyor?” İktisat ve Toplum, September 2011. Serdar Sayan, ”Cari açık ilelebet payidar kalacak mı?” İktisat ve Toplum, January 2020. Serdar Sayan, “Önsöz (ya da Ön Soru): Tasarruf Açığımız Aslında Bir Teknoloji Açığı Olabilir mi?” in M. Tiryakioğlu (ed.), Türkiye’nin Yerli Üretimi ve Politik Ekonomisi, İstanbul: Bilgi Üniversitesi Yayınları, 2021. |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

2

|

60

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

1

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

15

|

6

|

90

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

2

|

20

|

40

|

| Final Exam |

1

|

20

|

20

|

| Total |

198

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To improve and deepen expertise in economics and finance. |

-

|

-

|

-

|

-

|

X

|

|

| 2 |

To be able to comprehend the interaction between economics, finance and related fields. |

-

|

-

|

-

|

-

|

X

|

|

| 3 |

To be able to apply the advanced level knowledge acquired in economics and finance. |

-

|

-

|

-

|

-

|

X

|

|

| 4 |

To be able to create new knowledge by combining the knowledge of finance and economics with the knowledge coming from other disciplines and be able to solve problems which requires expert knowledge by applying scientific methods. |

-

|

-

|

-

|

-

|

X

|

|

| 5 |

To be able to use computer programs needed in the fields of economics and finance as well as information and communication technologies in advanced levels. |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to think analytically to identify problems in finance and economics and to be able to make policy recommendations in economics and finance based on scientific analysis of issues and problems. |

-

|

-

|

-

|

X

|

-

|

|

| 7 |

To be able to develop new strategic approaches for unexpected, complicated situations in finance and economics and take responsibility in solving it. |

-

|

-

|

-

|

X

|

-

|

|

| 8 |

To protect the social, scientific and ethical values at the data collection, interpretation and dissemination stages and to be able to institute and observe these values. |

-

|

-

|

-

|

-

|

X

|

|

| 9 |

To be able to critically evaluate the knowledge in finance and economics, to lead learning and carry out advanced level research independently. |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

To be able to use a foreign language for both following scientific progress and for written and oral communication. |

-

|

-

|

-

|

X

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

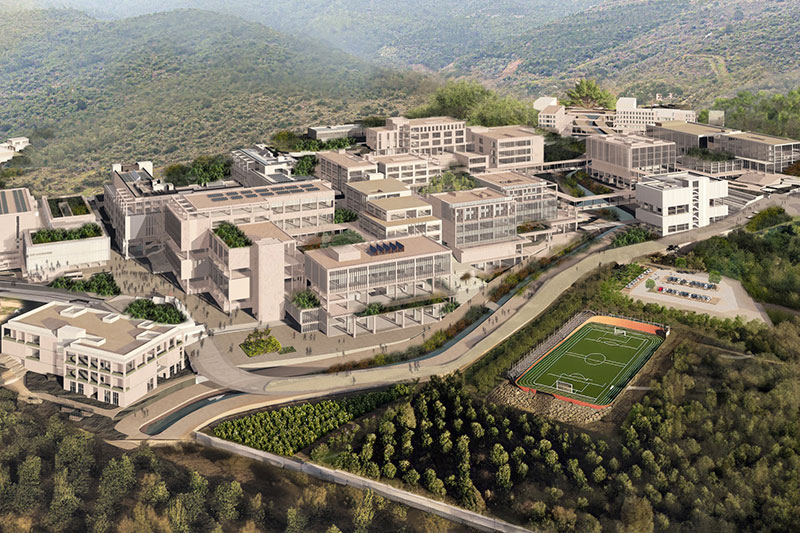

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..