KHUK 514 | Course Introduction and Application Information

| Course Name |

Actual Problems of Tax Law

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

KHUK 514

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | The aim of this course is to provide the analytical assessment and problem solving ability of the basic concepts and institutions of tax law within the framework of current problems. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | The course examines the current problems of tax law in the light of information related to other public law areas. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Discussions on the nature of taxation procedures | • Turgut Candan, Vergilendirme Yöntemleri ve Uzlaşma, Maliye ve Hukuk yay, Ankara 2006 • Celal Erkut, İdari İşlemin Kimliği, Danıştay yay, Ankara 1990 • Serkan Ağar, "Idari İslem Kuramı Perspektifinden Verginin Tarhı", www.idare.gen.tr/tarh.htm • Serkan Ağar, Vergi Yargısında Davaya Konu İcrai İşlem, TBB Dergisi, Y 2006, S 67, pp 285-316 |

| 2 | Discussions on the nature of tax cases | • Ahmet Kumrulu, Vergi Yargılama Hukukunun Kuramsal Temelleri, Ankara, 1989. • Lütfi Duran, “İdari İşlem Niteliğinde Yargı Kararıyla Vergi Davalarının Çözümü”, AİD, V. 21, N. 1, pp 3-14 • Serkan Ağar, "Vergi Davalarının Hukuki Niteliği", www.idare.gen.tr/agar-vergidavalari.htm |

| 3 | Problems related to tax procedure law | • Akkaya, M., “Vergi Sorumlusunun Vergi Yargısı ve Vergi İdaresi Karşısındaki Konumu”, AÜHF Dergisi, V. 46, N. 1-4, Ankara, 1997, pp 186-208 • Barış Bahçeci, Vergi Mahkemesinin Tarhiyat Tutarını Vergi İdaresi Yerine Belirlemesi, 3. Genç Vergi Hukukuçuları Konferansı, Adalet yay, Ankara 2015, pp 164-187 • Danıştay İçtihatları Birleştirme Kurulu kararı N: 2013/3, 2019/1, 08.02.2019 https://www.resmigazete.gov.tr/eskiler/2019/07/20190725-9.pdf |

| 4 | Responsibility for public claims | • Turgut Candan, Kanuni Temsilcinin Vergi ve Diğer Kamu Alacaklarından Sorumluluğu, Maliye ve Hukuk yay, Ankara 2006 • Turgut Candan, Açıklamalı Amme Alacaklarının Tahsil Usulü Hakkında Kanun, Maliye ve Hukuk yay, Ankara 2011 • Billur Yaltı, Vergi Hukukunda Sorumluluğun Sınırı: Mülkiyet Hakkı İnsan Hakları Avrupa Sözleşmesi ve Anayasa Çerçevesinde AATUHK 35 ve mükerrer 35, Prof. Dr. Mualla Öncel’e Armağan, Ankara 2009 • Barış Bahçeci, Kamu Alacağını Takip Hukuku, Seçkin yay Ankara 2019, pp 116-163 • Tahsilât Genel Tebliği, Seri A Sıra No 1 www.gib.gov.tr/sites/default/files/fileadmin/mevzuatek/eski/ Tahsilât_Genel_Tebligi_A1_27062018.pdf Turkish Constitutional Court judgment • E 2014/144, K 2015/291, 09.03.2015 • E 2016/14, K 2017/170, T 13.12.2017 |

| 5 | Discussions on the protection of personal data in taxation | • 6698 Sayılı Kişisel Verilerin Korunması Kanunu https://www.mevzuat.gov.tr/MevzuatMetin/1.5.6698.pdf ECtHR judgment • Satakunnan Markkinapörssi Oy And Satamedia Oy v. Finland http://hudoc.echr.coe.int/eng?i=001-175121 • Serkan Ağar, Vergi Mahremiyeti v Bilgi Edinme Hakkı, Ankara Barosu Dergisi, https://www.serkanagar.com.tr/cms-uploads/D%2011.pdf |

| 6 | Debates on the right to a fair trial in tax disputes | • Billur Yaltı, Vergi Yargılamasında Adil Yargılanma Hakkı: Anayasa Mahkemesi Kararlarında Uygulama Alanı Genişlemesi, https://anayasatakip.ku.edu.tr/wp-content/uploads/sites/34/2017/08/Billur-Yalt%C4%B1-Adil-Yarg%C4%B1lanma.pdf • Mahmut Kaşıkcı, Vergi Hukuku Özelinde Mahkemeye Erişim Hakki Üzerine Bir İnceleme, https://dergipark.org.tr/tr/pub/iuhfm/issue/36734/422586 ECtHR judgments: • Ferrazzini v. Italy http://hudoc.echr.coe.int/eng?i=001-59589 • Jussila v. Finland http://hudoc.echr.coe.int/eng?i=001-78135 |

| 7 | The European Court of Human Rights' case-law on tax penalties and its impact on Turkish law | • Barış Bahçeci, İnsan Hakları Avrupa Mahkemesi’nin Vergi Cezalarında ne bis in idem İçtihadı ile Türk Hukukunun Uyum Sorunu”, Türkiye Barolar Birliği Dergisi, V. 136, Y. 2018, pp 141-162 • Barış Bahçeci, İHAM İçtihadında Vergi Cezalarında ‘Ne Bis In Idem’, Ankara Üniversitesi Hukuk Fakültesi Dergisi, V 67, N 2, Y 2018, pp 253-278 ECtHR judgments: • A and B v. Norway, http://hudoc.echr.coe.int/eng?i=001-168972 • Glantz v. Finland, http://hudoc.echr.coe.int/eng?i=001-144114 |

| 8 | Debates on property rights in tax disputes | • Burak Gemalmaz, Mülkiyet Hakkı, Beta yay, İstanbul 2009, pp 501-511 • Barış Bahçeci, Takip Hukuku, pp 229-252 ECtHR judgment • Sace Elektrik Ticaret ve Sanayi AŞ v. Turkey, http://hudoc.echr.coe.int/eng?i=001-127105 Turkish Constitutional Court judgment • Ford Motor Company Application, http://www.kararlaryeni.anayasa.gov.tr/Content/pdfkarar/2014-13518.pdf • Türkiye İş Bankası AŞ Application, https://www.anayasa.gov.tr/media/5883/2016-2400.pdf |

| 9 | Midterm exam | |

| 10 | Debates on decisions on the right to family and housing in tax disputes | • İrfan Barlas, Kamu Alacaklarının Haciz Yoluyla Takibi, Onniki levha yay, İstanbul 2019, pp 55-62 • Barış Bahçeci, Takip Hukuku, pp 252- 276 • Gelir İdaresi Başkanlığı Tahsilât Genel Tebliği, Seri A Sıra No 1 http://www.gib.gov.tr/sites/default/files/fileadmin/mevzuatek/eski/ Tahsilât_Genel_Tebligi_A1_27062018.pdf ECtHR judgments: • Vaskrsic v. Slovenia, http://hudoc.echr.coe.int/eng?i=001-173102 • Rousk v. Sweden, http://hudoc.echr.coe.int/eng?i=001-123422 |

| 11 | Debates on non-discrimination in taxation | ECtHR judgments • Burden v. The United Kingdom http://hudoc.echr.coe.int/eng?i=001-86146 • İzzettin Doğan And Others v. Turkey http://hudoc.echr.coe.int/eng?i=001-162697 • Carson And Others v. The United Kingdom http://hudoc.echr.coe.int/eng?i=001-97704 Turkish Constitutional Court judgment • Reis Rs Enerji Elektrik Üretimi Motorlu Araçlar Tütün Ürünleri Dağitim Pazarlama Sanayi Ve Ticaret A.Ş. Application, https://kararlarbilgibankasi.anayasa.gov.tr/Basvurular/tr/pdf/2015-17259.pdf |

| 12 | Debates on legal certainty in tax transactions | ECtHR judgment: • OAO Neftyanaya Kompaniya Yukos v Russia, http://hudoc.echr.coe.int/eng?i=001-106308 Turkish Constitutional Court judgment: • Ford Motor Company Application, http://www.kararlaryeni.anayasa.gov.tr/Content/pdfkarar/2014-13518.pdf |

| 13 | Discussions on the proportionality of tax transactions | • Barış Bahçeci, Takip Hukuku, pp 276-291 • Meral SUNGURTEKİN ÖZKAN, Oranlılık İlkesi ve İlkenin İcra Hukukunda Uygulanması, Prof. Dr. Turhan Tufan Yüce’ye Armağan, Dokuz Eylül Üniversitesi yay, İzmir 2001, pp 190-200 ECtHR judgments: • N.K.M. v. Hungary, http://hudoc.echr.coe.int/eng?i=001-119704 • Zehentner v. Austria, http://hudoc.echr.coe.int/eng?i=001-93594 |

| 14 | Debates on the implementation of tax laws in terms of time | • Billur Yaltı, Vergi Hukukunda Geriye Yürümezlik Esası, Beta yay, İstanbul 2011 ECtHR judgments: • Khodorkovskiy and Lebedev v. Russia, http://hudoc.echr.coe.int/eng?i=001-122697 • Welch v. United Kingdom, http://hudoc.echr.coe.int/tur?i=001-57927 |

| 15 | Review of the semester | |

| 16 | Final Exam |

| Course Notes/Textbooks | BAHÇECİ Barış, Kamu Alacağını Takip Hukuku, Seçkin yay, Ankara 2019. ISBN/Ref: 9789750252808 |

| Suggested Readings/Materials | AĞAR Serkan, Vergi Tahsilâtından Kaynaklanan Uyuşmazlıklar ve Çözüm Yolları, Yaklaşım yay, Ankara 2009. ISBN: 978-605-5929-19-0 CANDAN Turgut, Açıklamalı Amme Alacaklarının Tahsil Usulü Hakkında Kanun, Maliye ve Hukuk yay, Ankara 2011. ISBN: 978-605-05-0264-0 |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury |

1

|

30

|

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

2

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

5

|

80

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

1

|

25

|

25

|

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

25

|

25

|

| Final Exam |

1

|

47

|

47

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

Consolidates the interpretation ability with an analytic and integral point of view on the basis of legal norms in the field of public law. |

-

|

-

|

-

|

-

|

X

|

|

| 2 |

Develops her/his knowledge in expertise level regarding the terms and institutions in public law and its subdivisions. |

-

|

-

|

-

|

-

|

X

|

|

| 3 |

Forms new information by combining theoretical and applied knowledge obtained in public law with the knowledge from different disciplines. |

-

|

-

|

-

|

-

|

X

|

|

| 4 |

Solves problems by using the theoretical and applied knowledge obtained in expertise level regarding private law. |

-

|

-

|

X

|

-

|

-

|

|

| 5 |

Uses the research methods unique to the area of public law. |

-

|

X

|

-

|

-

|

-

|

|

| 6 |

Transfers the knowledge and equipments to be obtained in expertise level regarding public law and its subdivisions in an efficient way both in written and verbally. |

-

|

-

|

-

|

-

|

-

|

|

| 7 |

Solves the legal problems especially, the disputes before the courts. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

Considers social, scientific and ethic values in the processing and evaluation phases of knowledge. |

-

|

X

|

-

|

-

|

-

|

|

| 9 |

Carries on a study independently which requires expertise in public law and its subdivisions. |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

Prepares an authentic dissertation/term project in compliance with the scientific criteria in public law. |

-

|

-

|

X

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

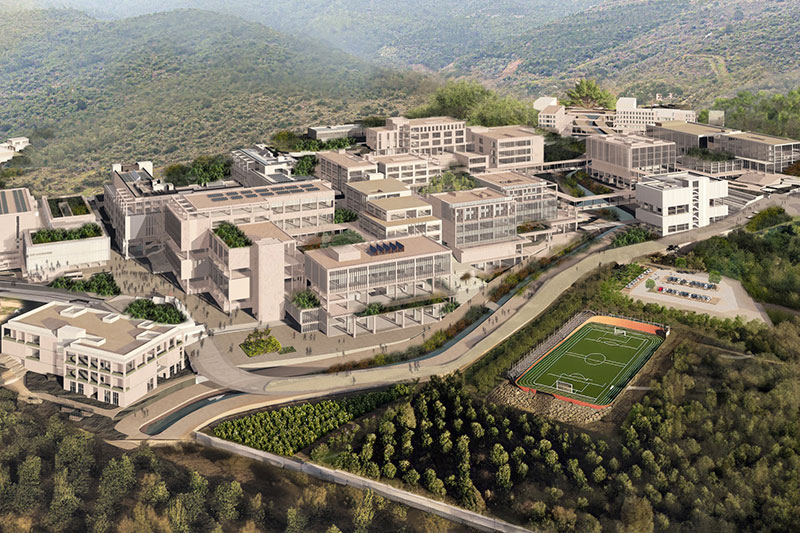

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..