KHUK 540 | Course Introduction and Application Information

| Course Name |

International Tax Law

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

KHUK 540

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | The aim of this course is to gain knowledge about basic concepts of international tax law, prevention of double taxation, interpretation of tax agreements, sharing of taxation authority, nature of transfer pricing, exchange of tax information, aid in tax collection and international tax disputes. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | Definition basic principles and concepts of international tax law, types of tax agreements and their legal and economic interpretation, economic implications of the sharing of taxation authority between the states are the objeckts of this course. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | General Principles of International Tax Law | Işık, 2014, Chapter 1 |

| 2 | Double Taxation | Işık, 2014, Chapter 2 |

| 3 | Tax Agreements | Işık, 2014, Chapter 3 |

| 4 | Basic Concepts in Sharing Taxation Authority | Işık, 2014, Chapter 4 |

| 5 | Share of Taxation Authority in Terms of Income and Wealth I | Işık, 2014, Chapter 5 |

| 6 | Share of Taxation Authority in Terms of Income and Wealth II | Işık, 2014, Chapter 5 |

| 7 | Transfer Pricing | Işık, 2014, Chapter 6 |

| 8 | Midterm Exam | - |

| 9 | Thin Capitalisation | Işık, 2014, Chapter 6 |

| 10 | Non Discrimination | Işık, 2014, Chapter 7 |

| 11 | Exchange of İnformation | Işık, 2014, Chapter 8 |

| 12 | Assistance in the Collection Taxes contracts | Işık, 2014, Chapter 9 |

| 13 | Elimination of Double Taxation | Işık, 2014, Chapter 11 |

| 14 | Settlement of International Tax Disputes | Işık, 2014, Chapter 12 |

| 15 | Review of the semester | |

| 16 | Final exam |

| Course Notes/Textbooks | Hüseyin IŞIK, Uluslararası Vergilendirme, İstanbul, 2014, , XII Levha Yayınları. |

| Suggested Readings/Materials | Billur Yaltı, Uluslararası Vergi Anlaşmaları, İstanbul, 1995, Beta Basım Yayım. |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury |

1

|

10

|

| Project |

1

|

20

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

3

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

15

|

6

|

90

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

1

|

15

|

15

|

| Project |

1

|

27

|

27

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

20

|

20

|

| Final Exam |

1

|

25

|

25

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

Consolidates the interpretation ability with an analytic and integral point of view on the basis of legal norms in the field of public law. |

-

|

-

|

-

|

-

|

X

|

|

| 2 |

Develops her/his knowledge in expertise level regarding the terms and institutions in public law and its subdivisions. |

-

|

-

|

-

|

X

|

-

|

|

| 3 |

Forms new information by combining theoretical and applied knowledge obtained in public law with the knowledge from different disciplines. |

-

|

X

|

-

|

-

|

-

|

|

| 4 |

Solves problems by using the theoretical and applied knowledge obtained in expertise level regarding private law. |

-

|

-

|

-

|

-

|

X

|

|

| 5 |

Uses the research methods unique to the area of public law. |

-

|

-

|

-

|

X

|

-

|

|

| 6 |

Transfers the knowledge and equipments to be obtained in expertise level regarding public law and its subdivisions in an efficient way both in written and verbally. |

-

|

-

|

-

|

-

|

-

|

|

| 7 |

Solves the legal problems especially, the disputes before the courts. |

-

|

-

|

-

|

-

|

X

|

|

| 8 |

Considers social, scientific and ethic values in the processing and evaluation phases of knowledge. |

-

|

-

|

X

|

-

|

-

|

|

| 9 |

Carries on a study independently which requires expertise in public law and its subdivisions. |

-

|

-

|

-

|

X

|

-

|

|

| 10 |

Prepares an authentic dissertation/term project in compliance with the scientific criteria in public law. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

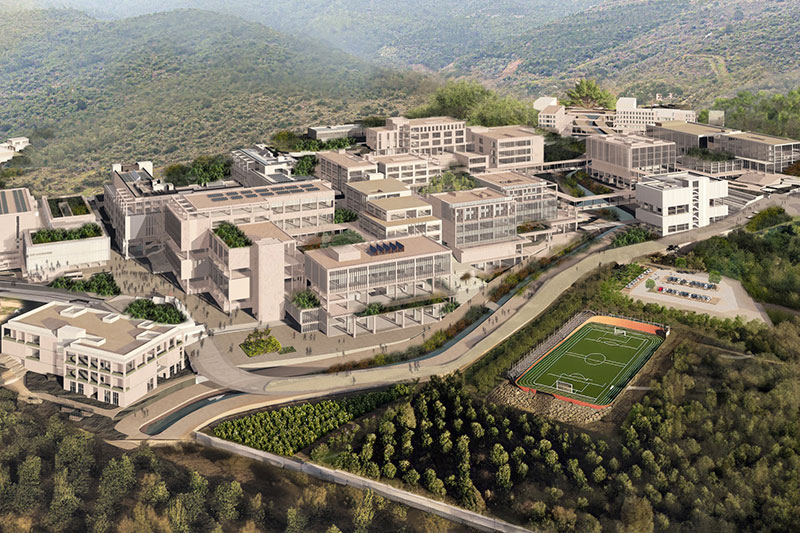

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..