Logistics Management (Without Thesis)

ITF 510 | Course Introduction and Application Information

| Course Name |

Investment Analysis and Portfolio Management

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ITF 510

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | - | |||||

| Assistant(s) | - | |||||

| Course Objectives | The Primary objective is to introduce graduate students the basic concepts of investing, the tools and principles to be able to better understand trading in financial markets. It is also aimed that students will be equipped with the knowledge for portfolio selection, portfolio management and investment evaluation through theoretical methodologies. Through solving the problems it is aimed to develop and increase the skills of the student in the field of investment and portfolio construction. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | Topics covered are: investment environment, market players, securities markets, portfolio risk and return, efficient diversification, CAPM and APT, Efficient market hypothesis and Behavioral Finance and Technical Analysis. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Introduction | |

| 2 | The Investment Environment: a) Real Assets / Financial Assets b) Financial Markets and the Economy c) Market Players d) Recent Trends | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 3 | Asset Classes and Financial Instruments: a) The Money Market b) The Bond Market c) Equity Securities d) Stock and Bond Market Indexes e) Derivative Markets | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 4 | Securities Markets: a) How firms Issue Securities: IPO b) US Securities Markets c) Types of Orders d) Short Sales | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 5 | Mutual Funds and Other Investment Companies: a) Investment Companies b) Mutual funds c) Cost of Investing in Mutual Funds d) Exchange Traded Funds | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 6 | Risk and Return: a) The Concept of Risk and Rates of Return in Financial Assets b) Risk and Return analysis c) Risk Premium d) Normal Distribution e) LongTerm Investments | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 7 | Risk and Return: a) The Concept of Risk and Rates of Return in Financial Assets b) Risk and Return analysis c) Risk Premium d) Normal Distribution e) LongTerm Investments | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 8 | Value at Risk Calculation | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 9 | Problem Solutions | |

| 10 | Midterm Exam | |

| 11 | Risk aversion and Capital Allocation to Risky Assets: a) Risk and Risk Aversion b) RiskFree Asset c) Passive Strategies: The Capital Market Line | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 12 | Index Models: a) The Single Index Model b) Portfolio Construction and the Single Index Model | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 13 | Capital Asset Pricing Model | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 14 | Arbitrage Pricing Theory | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition |

| 15 | Problem Solutions | |

| 16 | Review of the Semester |

| Course Notes/Textbooks | Zvi Bodie, Alex Kane, Alan J. Marcus, “Investments”, McGrawHill – 9th Edition, ISBN: 978-0078034695 |

| Suggested Readings/Materials | Financial Times, Wall Street Journal, The Economist, Journal of Portfolio Management, Financial Analysts Journal |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments |

1

|

30

|

| Presentation / Jury | ||

| Project |

1

|

30

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm | ||

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

2

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

0

|

||

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

2

|

16

|

32

|

| Presentation / Jury |

0

|

||

| Project |

1

|

60

|

60

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

0

|

||

| Final Exam |

1

|

70

|

70

|

| Total |

210

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 | Being able to contribute to the institution the participant works for and the logistics sector by the use of the knowledge and abilities gained during the education period; and manage change in the institution and the sector; |

-

|

-

|

-

|

-

|

-

|

|

| 2 | Reaching a competency about contemporary business and technology applications in the area of logistics and supply chain management and analysis and strategy development methods; |

-

|

-

|

-

|

-

|

-

|

|

| 3 | Being able to create opportunities by combining supply chain management with information technologies and innovative processes by the use of the interdisciplinary courses the participants take; |

-

|

-

|

-

|

-

|

-

|

|

| 4 | Having the ability to develop creative solutions by working on global logistics and supply chain subjects and realizing these by the use of their project management knowledge; |

-

|

-

|

-

|

-

|

-

|

|

| 5 | Having the knowledge, abilities and capabilities required for effective logistics and supply chain management by the use of a problem and case analysis based learning; |

-

|

-

|

-

|

-

|

-

|

|

| 6 | Being able to examine logistics and supply chain processes with the management science viewpoint, analyze related concepts and ideas by scientific methods; |

-

|

-

|

-

|

-

|

-

|

|

| 7 | If continuing to work in the academia, having the necessary information on logistics applications; if continuing to work in the sector, having the necessary knowledge on conceptual subjects; |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

Being able to specify appropriate research questions about his/her research area, conduct an effective research with the use of necessary methods and apply the research outcomes in the sector or the academia; |

-

|

-

|

-

|

-

|

-

|

|

| 9 | Being able to follow the changes and developments in the sector the participant works in, in order to keep his/her personal and professional competence updated and develop himself/herself when necessary; |

-

|

-

|

-

|

-

|

-

|

|

| 10 | Be experts in the fields of logistics and supply chain with the help of the sectorfocused education they receive; |

-

|

-

|

-

|

-

|

-

|

|

| 11 | Have the necessary capabilities to pursue doctoral studies in national and foreign institutions |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

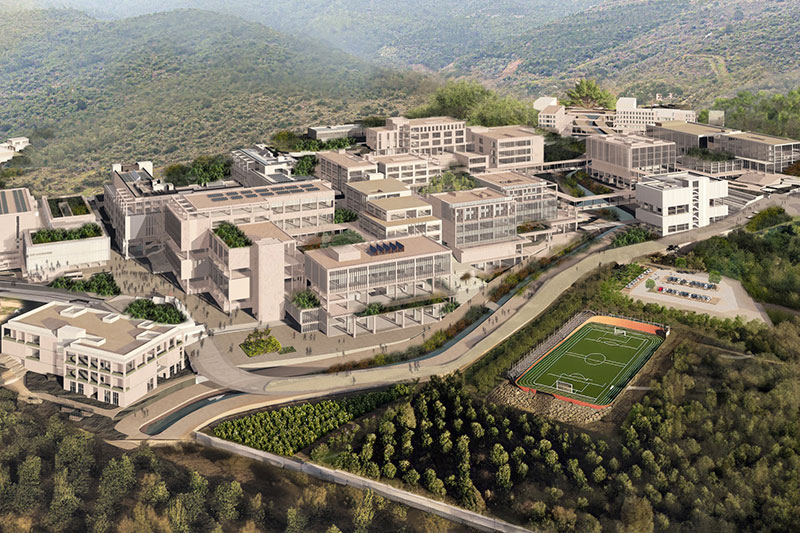

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..

You are one step ahead with your graduate education at Izmir University of Economics.