HUK 567 | Course Introduction and Application Information

| Course Name |

Tax Problems of Commercial Law

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

HUK 567

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | The aim of this lecture is to teach the consequences and solutions of the problems caused by tax liabilities in commercial law |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | The taxation problems encountered in commercial law are explained by examples and the place and effect of tax law rules are shown in the solution of commercial disputes |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Effects of Being Qualified as Merchant or Artisan According to Income Tax Law on Law of Enterprises | Barış Bahçeci, Vergisel Düzenleyici İşlemlerin Hukuksal Sınırları, Yetkin Ankara 2016, p 134-137. Yaşar Karayalçın, Ticaret Kanunun Başlangıç ve Tacire İlişkin Hükümleri, Banka Hukuku Dergisi V 5 Y 2007, p-34-78. İrfan Baştuğ, Tacir-Esnaf Ayrımı ve 25 Ocak 1986 Tarihli Bakanlar Kurulu Kararnamesi, İstanbul Barosu Dergisi, V 2, Y 1988, pp. 44-51. Celal Göle. Tacir-Esnaf Ayrımı, Batider, V. XII, p. 47-62 |

| 2 | Issues on Taxation of Transactions Between Holding Company and Group Companies | Haşim Akça, Vergisel Acıdan Holdinglerin Durumu, Sayıştay Dergisi, N:30 Y 1998, p 207-222. Related decisions of Court of Cassation |

| 3 | Taxation of Joint Ventures and Its Impact on Partnership Relations | Nurettin Bilici, Türk Vergi Sistemi, Adalet Ankara 2017, p 102-104. 1 seri nolu kurumlar vergisi genel tebliği, www.gib.gov.tr. Mustafa Dündar, İş Ortaklıklarının Vergilendirilmesi, TÜRMOB yay Ankara 2006, p 1-26. Ankara Vergi Dairesi Başkanlığının, 27/01/2012 128 sayılı özelgesi, İstanbul Vergi Dairesi Başkanlığının 25.10.2011 1875 sayılı Özelgesi, www.gib.gov.tr. Related advance rulings and decisions of Court of Cassation |

| 4 | Comparative Analysis of Bookkeeping Obligation According to Commercial Law and Tax Law | Ömer Faruk Batırel, “Tacirler, Türk Ticaret Kanunu ve Vergi Ödevi”, İstanbul Ticaret Ünv. Sosyal Bilimler Dergisi Y 2012 S 22, p 10-23 |

| 5 | Taxation of Share Transfer and Tax Avoidance Methods | Bumin Doğrusöz, Anonim Şirket Hisselerinin Devrinde Vergi, Dünya 24.12.2015, www.dunya.com Kurumlar Vergisi Genel Tebliği, www.gib.gov.tr |

| 6 | Distribution of Profits to Shareholders and Withholding Tax Problem | Ticari Kazançların Vergilendirilmesi Rehberi, www.gib.gov.tr Related decisions of Court of Cassation and Council of State |

| 7 | Effect of Full and Narrow Obligations on the Withholding Liability of Trade Companies | Related decisions of Turkish Government (5520 Sayılı Kurumlar Vergisi Kanununda Stopaj Oranlarında Değişikliğe İlişkin 2006/11447 Sayılı Bakanlar Kurulu Kararı) |

| 8 | Fiscal Responsibility of Partners of Limited Liability Companies | Binnur Çelik, Amme Alacaklarının Tahsil Usulü Hukuku, İş Bankası yay., İstanbul 2000, p 110-119. Yusuf Karakoç, Kamu İcra Hukuku, Yetkin Yayınevi Ankara 2015, p 134-138. Binnur Çelik, “Kamu Alacaklarının Korunması Bakımından Limited Şirket Ortaklarının Sorumluluğu”, G.Ü.İ.İ.B.F. Dergisi, C. 2, S. 4, 2000, p 1-17 |

| 9 | Fiscal Responsibility of Legal Representatives of Joint Stock Companies | Nurettin Bilici, Türk Vergi Sistemi, Adalet Ankara 2017, p 45-48. Binnur Çelik, Amme Alacaklarının Tahsil Usulü Hukuku, İş Bankası yay., İstanbul 2000, p 119-123. Yusuf Karakoç, Kamu İcra Hukuku, Yetkin Yayınevi Ankara 2015, p 138-146 |

| 10 | Recourse to Other Partners and Legal Representatives For Paid Taxes | Related decisions of Court of Cassation www.kazanci.com |

| 11 | Midterm exam | |

| 12 | Fiscal Liabilities of Attorney Partnerships | Related decisions of Court of Cassation www.kazanci.com |

| 13 | Legal Responsibility of Liquidators of Corporations | Binnur Çelik, “Tasfiye Memurlarının Sorumluluğu”, Mevzuat Dergisi, Başar Mevzuat Ve Bilgi Araştırma Merkezi Ltd. Şti., Yıl. 2, S. 22, Ekim, 1999, s 36-47 Nurettin Bilici, Türk Vergi Sistemi, Adalet Ankara 2017, s 50 |

| 14 | Fiscal Liabilities of Bankruptcy Office | Barış Bahçeci, İflas İdaresinin Kamu Alacağının İflas Masasına Kaydını Reddetmesi Sorunu, Ankara Ün. Hukuk Fakültesi Dergisi, Y. 2015 S 4, p 975-1040 |

| 15 | General Course Review | |

| 16 | Final exam |

| Course Notes/Textbooks | Nurettin Bilici, Türk Vergi Sistemi, Adalet Ankara 2017 Binnur Çelik, Amme Alacaklarının Tahsil Usulü Hukuku, İş Bankası yay., İstanbul 2000, Yusuf Karakoç, Kamu İcra Hukuku, Yetkin Yayınevi Ankara 2015. Barış Bahçeci, Vergisel Düzenleyici İşlemlerin Hukuksal Sınırları, Yetkin Ankara 2016 |

| Suggested Readings/Materials | As stated above under Related Preparation Section |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

40

|

| Final Exam |

1

|

60

|

| Total |

| Weighting of Semester Activities on the Final Grade |

40

|

|

| Weighting of End-of-Semester Activities on the Final Grade |

60

|

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

15

|

5

|

75

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

50

|

50

|

| Final Exam |

1

|

52

|

52

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

||||||

|

1

|

2

|

3

|

4

|

5

|

||||

| 1 | To consolidate the ability of interpretation of events on the basis of legal principles by analytical thinking in the field of private law. |

-

|

-

|

-

|

-

|

-

|

||

| 2 | The acquisition of knowledge on private law and its sub-disciplines. |

-

|

-

|

-

|

-

|

-

|

||

| 3 | To generate new information putting together the knowledge of various disciplines with theoretical and applied ones that are gained from expert level of private law. |

-

|

-

|

-

|

-

|

-

|

||

| 4 | To have the ability for utilizing theoretical and applied knowledge gaining from expert level of private law on the analysis of the problems. |

-

|

-

|

-

|

-

|

-

|

||

| 5 |

|

-

|

-

|

-

|

-

|

-

|

||

| 6 | To be able to convey the expert level of knowledge and equipment that will be possessed on private law and its sub-disciplines effectively verbally and in writing. |

-

|

-

|

-

|

-

|

-

|

||

| 7 | To be able to solve legal disputes, particularly those brought before the judicial bodies. |

-

|

-

|

-

|

-

|

-

|

||

| 8 | To be able to have effective communication skills. |

-

|

-

|

-

|

-

|

-

|

||

| 9 | To pursue social, scientific and ethical values during the processing and evaluation of knowledge. |

-

|

-

|

-

|

-

|

-

|

||

| 10 | To be able to conduct an independent study that requires specialty in the field of private law and about its sub-disciplines. |

-

|

-

|

-

|

-

|

-

|

||

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

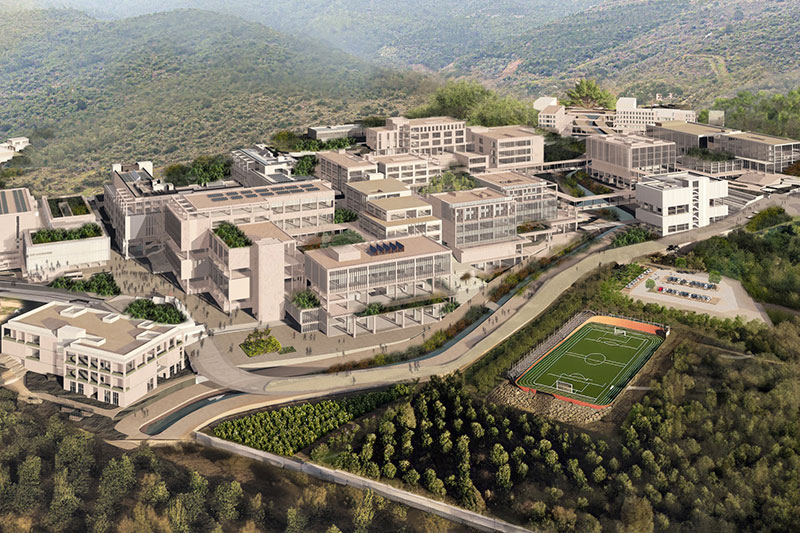

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..