HUK 570 | Course Introduction and Application Information

| Course Name |

Legal Aspects of Audit in Enterprises

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

HUK 570

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | Main financial tables and their risks the principles of internal auditing, external auditing, and tax examination in the framework of commercial law and tax law in enterprises, the results of the audit and examination and the solutions of the disputes regarding to tax examination. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | In the course, the concept of auditing and auditing standards will be explained. It will be emphasized that the basic financial statements prepared with accounting means what the decision makers care about. The legal aspects of the subject will be discussed by considering the legal regulations regarding the external audit and tax audit. Emphasis will be given to the risks of the assets, liabilities and equity management of the enterprises, and information will be given about the measures to be taken for the timely recognition of these risks. The content and preparation of the Situation Assessment Report, which is important in acquisitions, transfers and mergers, will be explained. Finally, the way of reconciliation and dispute resolution will be dealt with in the resolution of the disputes that will arise after the operation audits. In this way, the legal aspects of the audit in enterprises will be given. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses |

X

|

|

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Audit Concept | Denetim İlke ve Esasları, p.5-16, Güredin, p. 1-32 |

| 2 | Main Financial Tables | Muğan, Hoşal, 2012, s.180-217 |

| 3 | Risks in cash and inventory management | Denetim İlke ve Esasları, s.335- 369 Güredin, s. 371-404, s.427-446 |

| 4 | Risks in receivables and liabilities management | Denetim İlke ve Esasları, s.435- 453, 469-478 Güredin, s.405-426, 459 – 470 |

| 5 | Risks in long term assets management | Denetim İlke ve Esasları, s.406 – 420 Güredin, s. 447-458 |

| 6 | Risks in owner’s equity and income statement managemen | Denetim İlke ve Esasları, s.435- 453 Güredin, s. 485 -511 |

| 7 | Audit Standards | Denetim İlke ve Esasları, s.17-83 Güredin, s. 33- 62 |

| 8 | Midterm Exam | |

| 9 | Regulations for books and records | Türk Ticaret Kanunu md. 64-88, md.514-518, Vergi Usul Kanunu md. 182-186, 193-196, 210-212, 215-219 |

| 10 | Regulations for External Audit | Türk Ticaret Kanunu md. 397-406; Bağımsız Denetim Yönetmeliği md 1-10 |

| 11 | Regulations for Tax Examination | Bilici, 2021, s. 74-85 |

| 12 | The compromise path to follow the audit result | Bilici, 2021, s. 173-191 |

| 13 | The jurisdiction path to follow the audit result | Bilici, 2021, s. 192-224 |

| 14 | Due Diligence Report | The notes will be given by instructor. |

| 15 | Review of the semester | |

| 16 | Final Exam |

| Course Notes/Textbooks | Ersin Güredin, Denetim ve Güvence Hizmetleri, Türkmen Kitapevi, 14. Baskı, 2014 Bilici Nurettin, Vergi Hukuku Cilt:1, 52. Baskı, Savaş Yayınevi, Ankara 2021 C.Şımga Muğan and N.Hoşal Akman, Principles of Financial Accounting Based on IFRS, 5th Edition, McGrawHill,2012 |

| Suggested Readings/Materials | The notes will be given by Lecturer |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury |

1

|

10

|

| Project |

1

|

20

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

3

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

15

|

6

|

90

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

1

|

15

|

15

|

| Project |

1

|

27

|

27

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

20

|

20

|

| Final Exam |

1

|

25

|

25

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

||||||

|

1

|

2

|

3

|

4

|

5

|

||||

| 1 | To consolidate the ability of interpretation of events on the basis of legal principles by analytical thinking in the field of private law. |

-

|

-

|

-

|

-

|

X

|

||

| 2 | The acquisition of knowledge on private law and its sub-disciplines. |

-

|

-

|

-

|

-

|

X

|

||

| 3 | To generate new information putting together the knowledge of various disciplines with theoretical and applied ones that are gained from expert level of private law. |

-

|

-

|

-

|

-

|

X

|

||

| 4 | To have the ability for utilizing theoretical and applied knowledge gaining from expert level of private law on the analysis of the problems. |

-

|

-

|

-

|

-

|

X

|

||

| 5 |

|

-

|

-

|

-

|

-

|

X

|

||

| 6 | To be able to convey the expert level of knowledge and equipment that will be possessed on private law and its sub-disciplines effectively verbally and in writing. |

-

|

-

|

-

|

X

|

-

|

||

| 7 | To be able to solve legal disputes, particularly those brought before the judicial bodies. |

-

|

-

|

-

|

X

|

-

|

||

| 8 | To be able to have effective communication skills. |

-

|

X

|

-

|

-

|

-

|

||

| 9 | To pursue social, scientific and ethical values during the processing and evaluation of knowledge. |

-

|

X

|

-

|

-

|

-

|

||

| 10 | To be able to conduct an independent study that requires specialty in the field of private law and about its sub-disciplines. |

-

|

-

|

X

|

-

|

-

|

||

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

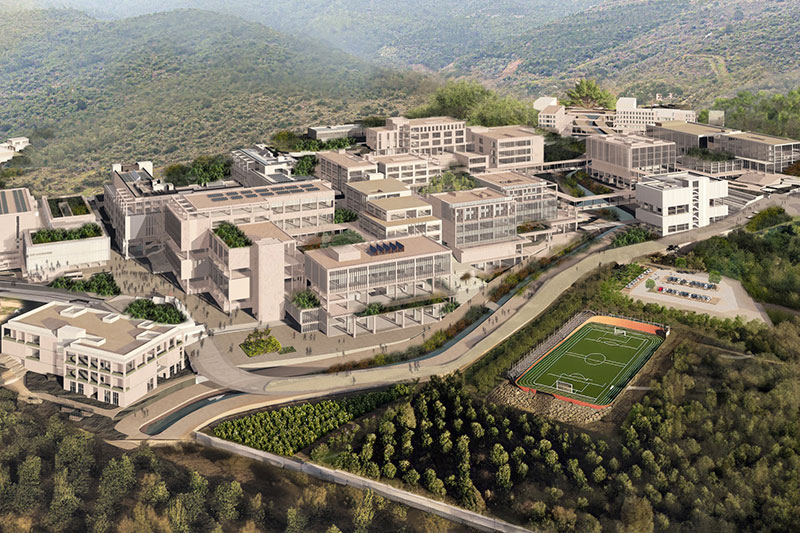

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..