ECON 514 | Course Introduction and Application Information

| Course Name |

Speculative Markets

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ECON 514

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | - | |||||

| Course Objectives | The aim of this course is to introduce the students to financial instruments that are classified as derivatives and show how these instruments can be used for hedging different risks. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | In recent years there has been phenomenal growth in the markets for futures contracts on financial assets, as well as options on these assets. Derivatives enable firms and portfolio managers to hedge a variety of risks. This course introduces the student to forward contracts, futures and options and walks the student through the process of using these instruments to hedge different risks. |

| Related Sustainable Development Goals |

|

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Introduction | |

| 2 | Financial forwards | |

| 3 | Financial futures | |

| 4 | Financial futures cont’d. | |

| 5 | Commodity forwards/futures | |

| 6 | Hedging with forwards/futures | |

| 7 | Hedging with forwards/futures cont’d. | |

| 8 | Swaps | |

| 9 | Swaps cont’d. | |

| 10 | Midterm | |

| 11 | Options | |

| 12 | American Options | |

| 13 | European Options | |

| 14 | Greeks | |

| 15 | Final Exam | |

| 16 | Review of the Semester |

| Course Notes/Textbooks | Options, Futures and Other Derivatives (6th edition), by John C Hull. |

| Suggested Readings/Materials |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation |

16

|

10

|

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project |

1

|

50

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

40

|

| Final Exam | ||

| Total |

| Weighting of Semester Activities on the Final Grade |

18

|

100

|

| Weighting of End-of-Semester Activities on the Final Grade | ||

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

6

|

96

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

1

|

30

|

30

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

20

|

20

|

| Final Exam |

0

|

||

| Total |

194

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to demonstrate general business knowledge and skills. |

-

|

-

|

-

|

-

|

-

|

|

| 2 |

To able to master the state-of-the-art literature in the area of specialization. |

-

|

-

|

-

|

-

|

-

|

|

| 3 |

To be able to evaluate the performance of business organizations through a holistic approach. |

-

|

-

|

-

|

-

|

-

|

|

| 4 |

To be able to effectively communicate scientific ideas and research results to diverse audiences. |

-

|

-

|

-

|

-

|

-

|

|

| 5 |

To be able to deliver creative and innovative solutions to business-related problems. |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to solve business related problems using analytical and technological tools and techniques. |

-

|

-

|

-

|

-

|

-

|

|

| 7 |

To be able to take a critical perspective in evaluating business knowledge. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To be able to exhibit an ethical and socially responsible behavior in conducting research and making business decisions. |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to carry out a well-designed independent and empirical research. |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

To be able to use a foreign language to follow information about the field of finance and participate in discussions in academic environments. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

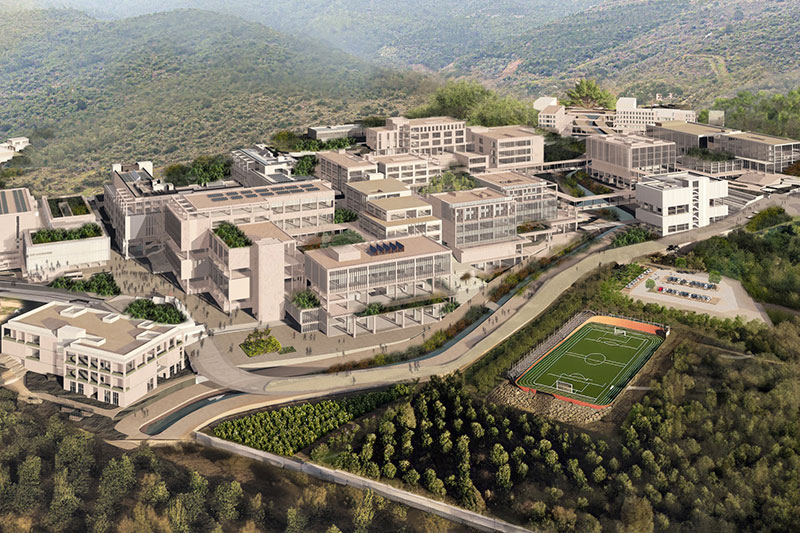

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..