ECON 527 | Course Introduction and Application Information

| Course Name |

Financial Economics

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

ECON 527

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | - | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | - | |||||

| Course Lecturer(s) | ||||||

| Assistant(s) | ||||||

| Course Objectives | The aim of this course is to introduce students to some basic concepts in financial economics and to establish its roots in micro and macroeconomics and general equilibrium theory. The main objective is to introduce key concepts and theories in economics that are useful in understanding about and guiding decisionmakers in financial markets. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | This course takes the student from the level of microeconomics principles to current theories and topics in financial economics. The course will survey and introduce assetpricing models.. ArrowDebreu and Radner general equilibirium theories are developed and combined with NeumannMorgenstern utility theory. Both static and dynamic models are explored. Asset pricing models with and without arbitrage opportunities are discussed. Asset prcing puzzles are investigated. ModiglianiMiller arguments on capital structure are introduced. Binomial option pricing model is developed. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Introduction | |

| 2 | Single Period Consumption, Portfolio Choice, and Asset Pricing | LeRoy and Werner; Chapters 8, 9, and 10.*Machina, M. J. 1987. “Choice Under Uncertainty: Problems Solved and Unsolved.” Journalof Economic Perspectives 1:12154.MasColell, Whinston, and Green; Chapter 6.Pratt, J. W. 1964. “Risk Aversion in the Small and in the Large.” Econometrica 32:12236.*Pennacchi; Chapter 1.*Rabin, M. 2000. “Risk Aversion and ExpectedUtility Theory: A Calibration Theorem.”Econometrica 68:128192. |

| 3 | Consumption Savings and Asset Pricing | Lintner, J. 1965. “The Valuation of Risky Assets and the Selection of Risky Investments inStock Portfolios and Capital Budgets.” Review of Economics and Statistics 47:1337.*Pennacchi; Chapter 3.Mossin, J. 1966. “Equilibrium in a Capital Asset Market.” Econometrica 34:76883.Roll, R. 1977. "A Critique of the Asset Pricing Theory's Tests Part I: On Past and PotentialTestability of the Theory." Journal of Financial Economics 4:12976.Ross, S. A. 1976. “The Arbitrage Theory of Capital Asset Pricing.” Journal of EconomicTheory 13:34160.Sharpe, W. F. 1964. “Capital Asset Prices: A Theory of Market Equilibrium under Conditionsof Risk.” Journal of Finance 19:42542. |

| 4 | Multi Period Discrete Time Models of Consumption and Portfolio Choice | *Hall, R. E. 1978. "Stochastic Implications of the Life CyclePermanent Income Hypothesis:Theory and Evidence." Journal of Political Economy 86:97187. |

| 5 | MultiPeriod Market Equilibrium | *Cochrane, J. H. 1991. "A Simple Test of Consumption Insurance." Journal of PoliticalEconomy 99:957976.*Cochrane; Chapters 10 and 11.Hansen, L. P., and K. J. Singleton. 1982. "Generalized Instrumental Variables Estimation ofNonlinear Rational Expectations Models." Econometrica 50:126988.. 1984. "Errata." Econometrica 52:26768.Lucas, R. E. 1978. "Asset Prices in an Exchange Economy." Econometrica 46:142946.*Mace, B. J. 1991. "Full Insurance in the Presence of Aggregate Uncertainty." Journal ofPolitical Economy 99:92856.*Pennacchi; Chapter 6.Townsend, R. M. 1995. “Consumption Insurance: An Evaluation of RiskBearing Systems inLowIncome Economies.” Journal of Economic Perspectives 9:83102. |

| 6 | Basics of Derivative Pricing – Binomial Model | |

| 7 | Dynamic Hedging | |

| 8 | Continuous Time Consumption and Portfolio Choice | |

| 9 | Asset Pricing in Continuous Time | |

| 10 | Behavioral Finance and Asset Pricing | Barberis, N., M. Huang, and T. Santos. 2001. "Prospect Theory and Asset Prices." QuarterlyJournal of Economics 116:153.*Barberis, N., and R. Thaler. 2003. "A Survey of Behavioral Finance." In Constantinides, G.,M. Harris, and R. Stulz, Handbook of Behavioral Finance, Volume 1B, Chapter 18, pp.10531123. New York: Elsevier North Holland.Kahneman, D., and R. H. Thaler. 2006. “Utility Maximization and Experienced Utility.” Journalof Economic Perspectives 20(Winter):221–34.*Lo, A. W. 2004. “The Adaptive Market Hypothesis.” Journal of Portfolio Management 30(Anniversary Issue):1529.Kogan, L., S. Ross, J. Wang, and M. Westerfield. 2006. “The Price Impact and Survival ofIrrational Traders.” Journal of Finance 61:195229.Pennacchi; Chapter 15.Thaler, R., and S. Benartzi. 2004. “Save More Tomorrow: Using Behavioral Economics toIncrease Employee Saving.” Journal of Political Economy 112:S165S189. |

| 11 | Valuation Under Asymmetric Information | |

| 12 | Asymmetric Information, Trading, and Markets | |

| 13 | Models of the Term Structure of Interest Rates | Duffie, D., and K. J. Singleton. 1999. "Modeling Term Structures of Defaultable Bonds."Review of Financial Studies 12:687720.Merton, R. C. 1974. "On the Pricing of Corporate Debt: The Risk Structure of Interest Rates."Journal of Finance 29:44970. |

| 14 | Models of Credit Risk | |

| 15 | Final Exam | |

| 16 | Review of the Semester |

| Course Notes/Textbooks | Lengwiler, Yvan, Microfoundations of Financial Economics, Princeton University Press, 2006. |

| Suggested Readings/Materials | Fabozzi, F., Neave, E. and Zhou, G., Financial Economics, Wiley, 2012. |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury | ||

| Project |

1

|

40

|

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

30

|

| Total |

| Weighting of Semester Activities on the Final Grade |

2

|

70

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

30

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

16

|

2

|

32

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

0

|

||

| Project |

1

|

45

|

45

|

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

50

|

50

|

| Final Exam |

1

|

50

|

50

|

| Total |

225

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to demonstrate general business knowledge and skills. |

-

|

-

|

-

|

-

|

-

|

|

| 2 |

To able to master the state-of-the-art literature in the area of specialization. |

-

|

-

|

-

|

-

|

-

|

|

| 3 |

To be able to evaluate the performance of business organizations through a holistic approach. |

-

|

-

|

-

|

-

|

-

|

|

| 4 |

To be able to effectively communicate scientific ideas and research results to diverse audiences. |

-

|

-

|

-

|

-

|

-

|

|

| 5 |

To be able to deliver creative and innovative solutions to business-related problems. |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to solve business related problems using analytical and technological tools and techniques. |

-

|

-

|

-

|

-

|

-

|

|

| 7 |

To be able to take a critical perspective in evaluating business knowledge. |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To be able to exhibit an ethical and socially responsible behavior in conducting research and making business decisions. |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to carry out a well-designed independent and empirical research. |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

To be able to use a foreign language to follow information about the field of finance and participate in discussions in academic environments. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

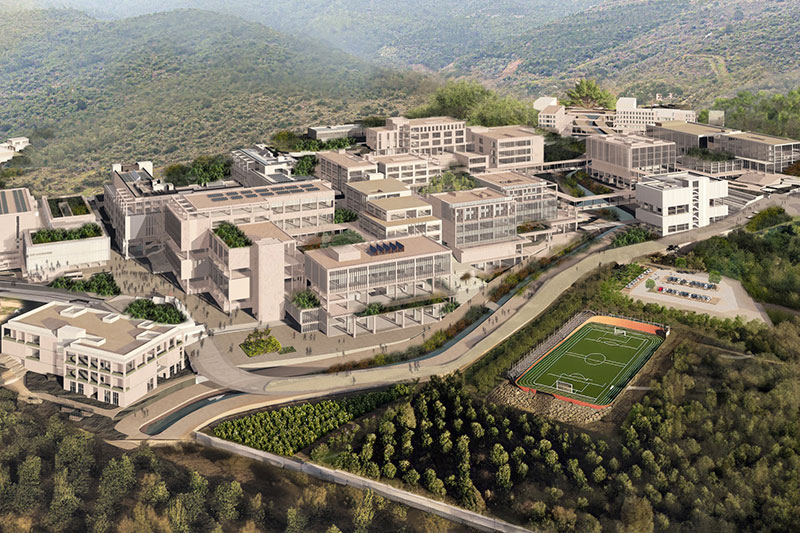

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..