BA 560 | Course Introduction and Application Information

| Course Name |

Financial Accounting

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

BA 560

|

Fall/Spring

|

3

|

0

|

3

|

7.5

|

| Prerequisites |

None

|

|||||

| Course Language |

English

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Second Cycle

|

|||||

| Mode of Delivery | - | |||||

| Teaching Methods and Techniques of the Course | Problem SolvingLecture / Presentation | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | ||||||

| Assistant(s) | ||||||

| Course Objectives | The Financial accounting course introduces the principles of accounting, focuses on the preparation of financial statements and how decision makers use this information. Throughout this course students will be provided with financial accounting concepts to give an understanding of how accounting information is made available for users. Moreover, how to use accounting information in decision making process will be examined. Basic accounting issues will be covered more detailed in the context of graduate students. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | This course aims to set the fundamental basis for the future accounting and finance courses by covering the bookkeeping process and the reporting of the basic financial statements as the balance sheet, income statement, the statement of cash flows, and the statement of stockholder’s equity. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses | ||

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Financial accounting and its economic context | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 1; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 1 |

| 2 | A closer look at financial statements, the principles of accounting, the fundamental accounting equation | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapters 2 and 3; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 2 |

| 3 | Financial statements and underlying accounting concepts: The mechanics of accounting, recording business transactions, preparing the unadjusted trial balance | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 4; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 2 |

| 4 | Completing the Accounting Cycle | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 4; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 3 |

| 5 | Preparing cash-flow statement and using financial statement information: What is the indirect method of cash-flow statement? | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 14; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapters 6 and 13 |

| 6 | Merchandise Transactions | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 7; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 4 |

| 7 | Inventory: LIFO, FIFO, and average cost methods | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 7; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 4 |

| 8 | Midterm | |

| 9 | Noncurrent assets: What is depreciation? What are the methods of depreciation? | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapter 9; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapter 10 |

| 10 | What are the current and the long term liabilities? What are the provisions and contingent liabilities? What are the shareholder's equity items? | Financial Accounting in an Economic Context, 10th Edition, Jamie Pratt, Michael Peters (Wiley, 2017), chapters 10 and 12; Principles of Financial Accounting based on IFRS, 5th Edition, Sımga-Mugan, C., Hosal-Akman, N. (McGraw-Hill, 2012), chapters 8, 11 and 12 |

| 11 | Presentation | |

| 12 | Presentation | |

| 13 | Presentation | |

| 14 | Presentation | |

| 15 | Review of the semester | |

| 16 | Final Exam |

| Course Notes/Textbooks | Pratt, J., Peters, F.M. (2017), Financial Accounting in an Economic Context, 10th Edition, Wiley, ISBN: 978-1-119-30616-0 (http://bcs.wiley.com/he-bcs/Books?action=index&itemId=1119306167&bcsId=10565) Sımga-Mugan, C., Hosal-Akman, N. (2012), Principles of Financial Accounting based on IFRS, 5th Edition, McGraw-Hill, ISBN 9780077145934 (http://highered.mheducation.com/sites/0077138058/information_center_view0/book_preface.html) |

| Suggested Readings/Materials | Nobles, Mattison, Matsumura (2017), Horngren’s Accounting, 12th edition, Pearson, ISBN-13: 978-0134486789 |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation | ||

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments | ||

| Presentation / Jury |

1

|

20

|

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

40

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

2

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

14

|

4

|

56

|

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

0

|

||

| Presentation / Jury |

1

|

25

|

25

|

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

40

|

40

|

| Final Exam |

1

|

45

|

45

|

| Total |

214

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to demonstrate general business knowledge and skills. |

-

|

-

|

X

|

-

|

-

|

|

| 2 |

To able to master the state-of-the-art literature in the area of specialization. |

-

|

-

|

-

|

-

|

-

|

|

| 3 |

To be able to evaluate the performance of business organizations through a holistic approach. |

-

|

-

|

-

|

-

|

-

|

|

| 4 |

To be able to effectively communicate scientific ideas and research results to diverse audiences. |

-

|

-

|

-

|

-

|

-

|

|

| 5 |

To be able to deliver creative and innovative solutions to business-related problems. |

-

|

-

|

X

|

-

|

-

|

|

| 6 |

To be able to solve business related problems using analytical and technological tools and techniques. |

-

|

-

|

X

|

-

|

-

|

|

| 7 |

To be able to take a critical perspective in evaluating business knowledge. |

-

|

X

|

-

|

-

|

-

|

|

| 8 |

To be able to exhibit an ethical and socially responsible behavior in conducting research and making business decisions. |

-

|

-

|

X

|

-

|

-

|

|

| 9 |

To be able to carry out a well-designed independent and empirical research. |

-

|

-

|

-

|

X

|

-

|

|

| 10 |

To be able to use a foreign language to follow information about the field of finance and participate in discussions in academic environments. |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

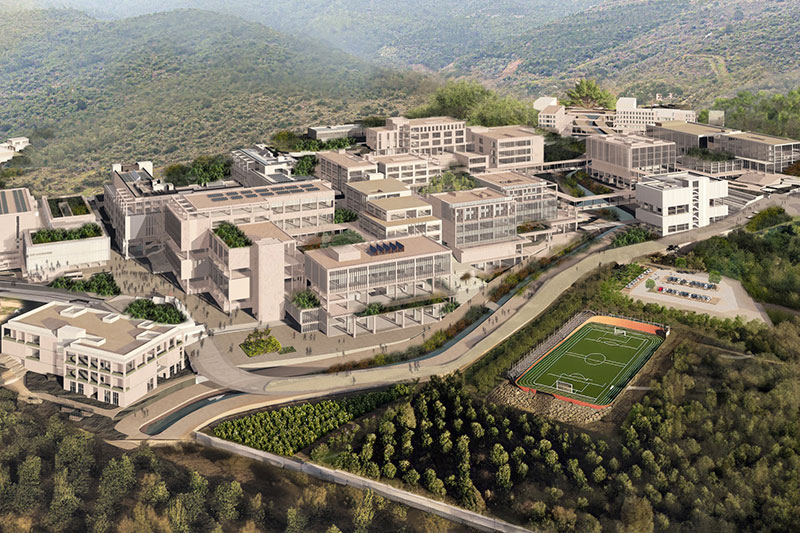

NEW GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..